Wyoming Credit Unions: Find the Perfect Financial Partner Near You

Wyoming Credit Unions: Find the Perfect Financial Partner Near You

Blog Article

Why Credit Rating Unions Are the Key to Financial Success

Credit score unions have arised as a compelling choice for those looking to enhance their economic well-being. With an emphasis on tailored remedies and community-driven initiatives, debt unions stand out as essential gamers in fostering economic success.

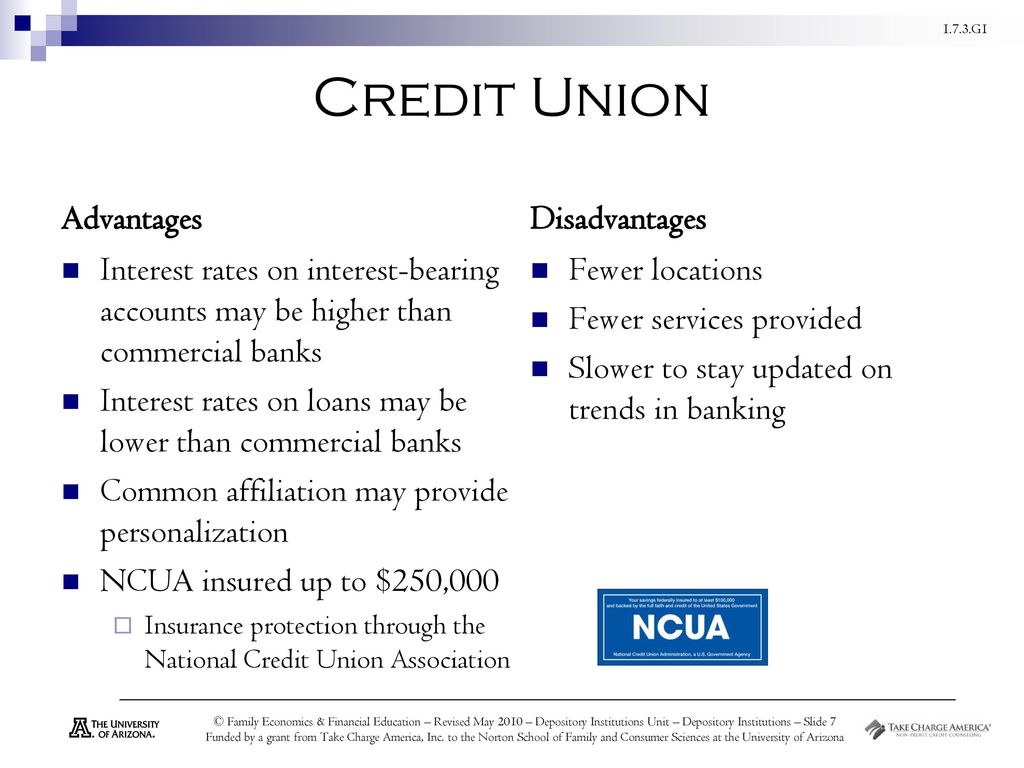

Advantages of Joining a Credit Rating Union

Signing up with a cooperative credit union supplies numerous advantages that can favorably affect one's financial wellness. One substantial advantage is the feeling of community that debt unions foster. Unlike conventional banks, credit rating unions are member-owned cooperatives, which indicates that each participant has a voice in just how the union runs. This democratic structure commonly brings about an extra customized banking experience, with a concentrate on meeting the demands of the participants instead than making the most of profits.

Furthermore, cooperative credit union often provide far better client service than larger banks. Members often report greater fulfillment levels due to the personalized focus they get. This commitment to member solution can result in tailored financial remedies, such as customized funding alternatives or monetary education programs, to assist members attain their monetary goals.

Moreover, being a component of a lending institution can use access to a range of monetary products and solutions, frequently at more competitive prices and with lower charges than standard banks. This can cause cost financial savings with time and contribute to total financial stability.

Competitive Prices and Reduced Charges

Cooperative credit union are recognized for providing affordable rates and lower fees contrasted to traditional financial institutions, providing members with cost-efficient financial services. Among the key advantages of lending institution is their not-for-profit standing, enabling them to prioritize participant advantages over making the most of profits. This distinction in framework often equates into much better passion rates on cost savings accounts, lower rate of interest on lendings, and minimized charges for different solutions.

Personalized Financial Services

With a concentrate on meeting individual monetary demands, cooperative credit union master offering individualized financial solutions customized to improve member satisfaction and economic success. Unlike typical financial institutions, lending institution prioritize comprehending their members' unique economic situations to offer tailored remedies. This individualized strategy permits lending institution to supply a range of services such as personalized economic recommendations, tailored loan choices, and individualized financial savings plans.

Members of credit score unions can profit from individualized monetary solutions in numerous means. Furthermore, credit scores unions provide customized monetary recommendations to assist members achieve their financial goals, whether it's conserving for a major purchase, planning for retirement, or improving credit score ratings.

Neighborhood Assistance and Interaction

Stressing public participation and promoting interconnectedness, lending institution proactively add to their areas via durable support campaigns and purposeful engagement programs. Community assistance goes to the core of cooperative credit union' worths, driving them to exceed simply economic solutions. These establishments commonly organize and participate in different neighborhood events, charity drives, and volunteer activities to return and enhance the areas they serve.

One way lending institution show their commitment to community assistance is by using financial education and learning and proficiency programs. By providing Get More Information sources and workshops on budgeting, saving, and investing, they equip people to make informed monetary decisions, ultimately adding to the general well-being of the area.

Additionally, cooperative credit union frequently partner with regional services, institutions, and nonprofit companies to attend to certain neighborhood requirements. Whether it's supporting small services with loaning programs or sponsoring educational efforts, credit rating unions play an essential role in driving favorable modification and fostering a feeling of belonging within their neighborhoods. Through these collaborative initiatives, lending institution not just improve monetary success but likewise grow a more comprehensive and resilient society.

Building a Strong Financial Structure

Developing a strong monetary base is vital for long-term prosperity and stability in individual and service finances. Building a strong financial foundation includes a number of essential parts. The initial step is developing a sensible spending plan that lays out earnings, financial investments, costs, and cost savings. A budget plan offers as a roadmap for financial decision-making and helps people and businesses track their economic progression.

Alongside budgeting, it is important to establish an emergency situation fund to cover unanticipated expenditures or monetary problems. Normally, economists advise saving three to 6 months' worth of living costs in a quickly available account. This fund offers a safety and security web during challenging times and protects against individuals from entering into financial obligation to manage emergencies.

In addition, managing financial obligation plays a considerable role in solidifying economic foundations. Credit Union in Cheyenne Wyoming. It is necessary to keep financial debt degrees workable and work in the direction of settling high-interest financial debts as swiftly as possible. By lowering financial debt, companies and individuals can liberate extra sources for spending and conserving, inevitably strengthening their monetary position for the future

Verdict

In final thought, lending institution play an important duty in advertising monetary success with their special benefits, including competitive prices, personalized services, area assistance, and financial education and learning. By focusing on participant contentment and actively engaging with local areas, credit unions help businesses and individuals alike construct a strong financial structure for long-term prosperity and stability. Signing up with a credit from this source scores union can be a strategic decision for those looking for to attain financial success.

This devotion to member solution can result in customized monetary solutions, such as individualized funding options or economic education and learning programs, to help participants attain their monetary objectives.

A spending plan serves as a roadmap for financial decision-making and assists services and individuals track their economic development.

In verdict, debt unions play a vital duty i loved this in advertising financial success via their distinct advantages, including affordable prices, personalized services, area support, and economic education and learning.

Report this page